Introduction

Introduction

Chainalysis Market Intel provides the unique insights you need to make cryptocurrency research and investment decisions.

Market Intel is built on the Chainalysis data set, which means you get industry-leading accuracy and coverage of cryptocurrency activity. Chainalysis traces all the funds flowing on the blockchain and tracks the cryptocurrency activity of over 3,300 businesses. This translates into intelligence on over 95% of the cryptocurrencies traded on the market. Our data is trusted by hundreds of customers who use it every day to make research, investment, compliance, and law enforcement decisions.

We provide on-chain data, that is the transfer of cryptocurrency recorded on the blockchain. We structure on-chain data, by combining it with our own proprietary data and techniques, to show how cryptocurrency is transferred and held by real-world entities. This means our metrics describe tangible, real-world activity rather than technical blockchain metrics.

As all transfers are recorded on the blockchain in real-time, on-chain data, once mapped to real-world entities, is a powerful dataset. It is a complete and real-time description of how cryptocurrency is being used and held. This offers new ways to value cryptocurrencies, and understand the market and the broader crypto-economy, as we can see how assets move in response, or to cause, events. This is impossible to do in the traditional economy.

Subscriptions

Chainalysis Market Intel is available via a data subscription, delivered via API and CSV flat files.

We offer three subscriptions:

- Core: essential metrics to understand cryptocurrency use over the last 365 days rolling.

- Advanced: Core + comprehensive metrics on cryptocurrency usage, from the genesis of the assets, for those actively investing in cryptocurrency or the industry.

- Premium: Advanced + exclusive data on the blockchain activity of over 3,300 individual businesses, from the genesis of the assets, for unparalleled insights. The Premium and Advanced subscriptions provide more metrics, for a longer historical time window, compared to the Core subscription.

To learn more and purchase a subscription please contact us at marketintel@chainalysis.com.

You can also view a selection of our metrics at https://markets.chainalysis.com.

Definitions

General definitions

Some general terms benefit from definition:

- Asset: an asset is a cryptocurrency. Assets have an asset value and a USD value. For example if one bitcoin is sent then the asset value that is sent is one bitcoin, and the USD value of the asset that is sent is the USD price of the bitcoin at the time it is sent.

- Entity: an entity is the set of blockchain addresses controlled by a person or service. At Chainalysis we aggregate addresses to the largest set we are certain is controlled by a single entity. Entities are people (who are anonymous) and services (which are mostly identified). Services are essentially businesses, such as an exchange or an online shop, but can include entities that are not traditional businesses, such as a smart contract. An entity can hold assets, and send and receive assets via transfers with another entity.

- Time: data is provided in UTC time periods in ISO 8601 format. We record data on transfers in the time period that a block containing the transfer is broadcast to the network. That is to say when a transfer is first included in the blockchain. This can be different from the time that a transfer is broadcast to the network, however this difference is typically only important when analysing data in time periods of less than day.

- Time periods: data is provided in time periods, for example per day or per week. Daily and weekly time periods contain data generated between 00:00:00Z at the start of the time period and 23:59:59Z at the end of the time period. A week starts at 00:00:00Z on a Monday and ends at 23:59:59Z on a Sunday. When days of the week are numbered, Monday is 1 and Sunday is 7. Variables that describe a flow, such as assets transferred, give data on the flow occurring within the time period. For example, daily data on assets transferred on 2020-01-01 describes the assets transferred during the UTC day of 2020-01-01, that is between 2020-01-01T00:00:00Z and 2020-01-01T23:59:59Z. Variables that describe a state, such as assets held or market cap, give data on the state at the end of the time period. For example, daily data on assets held on 2020-01-01 describes the assets held at the end of the UTC day of 2020-01-01, that is as of 2020-01-01T23:59:59Z.

Assets

Metrics are provided for the following core assets:

| Asset | Symbol | Asset type | Generation type |

|---|---|---|---|

| Bitcoin | BTC | Blockchain | Mined |

| Bitcoin Cash | BCH | Blockchain | Mined |

| Dogecoin | DOGE | Blockchain | Mined |

| Ethereum | ETH | Blockchain | Mined |

| Litecoin | LTC | Blockchain | Mined |

| XRP | XRP | Blockchain | Mined |

| 0x | ZRX | DeFi token | Issued |

| Aave | AAVE | DeFi token | Issued |

| Bancor | BNT | DeFi token | Issued |

| Compound | COMP | DeFi token | Issued |

| Curve | CRV | DeFi token | Issued |

| LoopringCoin | LRC | DeFi token | Issued |

| Maker | MKR | DeFi token | Issued |

| renBTC | RENBTC | DeFi token | Issued |

| SushiSwap | SUSHI | DeFi token | Issued |

| Uniswap | UNI | DeFi token | Issued |

| Wrapped Bitcoin | WBTC | DeFi token | Issued |

| Wrapped Ethereum | WETH | DeFi token | Issued |

| yearn.finance | YFI | DeFi token | Issued |

| Binance USD | BUSD | Stablecoin | Issued |

| Dai | DAI | Stablecoin | Issued |

| Gemini Dollar | GUSD | Stablecoin | Issued |

| Pax Dollar | USDP | Stablecoin | Issued |

| Tether | USDT | Stablecoin | Issued |

| Tether on Bitcoin | USDT_BTC | Stablecoin | Issued |

| Tether on Ethereum | USDT_ETH | Stablecoin | Issued |

| TrueUSD | TUSD | Stablecoin | Issued |

| USD Coin | USDC | Stablecoin | Issued |

Tether (UDST) is Tether combined across Bitcoin and Ethereum blockchains (USDT_BTC and USDT_ETH). Tether metrics are calculated as the sum of values on each blockchain. It does not include metrics that measure distributions, such as quartiles, as the sum of distributions may be misleading if an entity holds USDT on different blockchains but these holdings are not combined.

A limited number of metrics are only available for specific assets. When this is the case it is described in the notes of the metric.

Premium and Advanced subscribers can also request other mature assets to be included in their subscription.

If you are interested in metrics for other assets, please make a request to marketintel@chainalysis.com.

Entity categories

Entities are people (who are anonymous) and services (which are mostly identified). Services are essentially businesses, such as an exchange or an online shop, but can include entities that are not traditional businesses, such as a smart contract.

Entities are grouped into the following categories, depending on whether they are people, so self-host their cryptocurrency activity in a personal wallet, or services, in which case they are categorised by their type of business:

| Entity category | Definition |

|---|---|

| crypto-to-crypto exchanges | Venues for the trading of cryptocurrencies primarily for other cryptocurrencies, either via a central limit order book or peer-to-peer via a centralised escrow. |

| crypto-to-fiat exchanges | Venues for the trading of cryptocurrencies primarily for fiat, either via a central limit order book or peer-to-peer via a centralised escrow. |

| derivatives-only exchanges | Venues that only offer the trading of cryptocurrency derivatives via a central limit order book. |

| decentralized exchanges | Venues for the trading of cryptocurrencies via automated smart contracts. Trades on a decentralized platform are peer-to-peer and have no third party or central authority other than the smart contract which executes the trades. |

| other exchanges | All other exchanges not elsewhere classified. |

| defi | Decentralized Finance represents smart contracts that facilitate financial intermediation of cryptocurrencies, for example lending or crowdfunding. Decentralized exchanges are included in the exchanges category. |

| generation | Generation represents the issuance of new units of cryptocurrency, for example as mining rewards, the destination of fees, and the sink of units that are burnt or redeemed if an asset allows this, as stablecoins do. Mining pools are included in the generation category except for metrics specifically regarding Mining pools. Mining pools are services that enable individual miners to collectively deploy their resources, so that the pool mines assets more frequently but the reward is shared among the individual miners. |

| illicit entities | Entities engaged in activity using cryptocurrency on the blockchain that is considered illicit in most jurisdictions. Illicit entities are further grouped, as described by Illicit entity categories, depending on the nature of illicit activity. |

| merchant services | Merchant services are authorized financial services that enable businesses to accept payments on their customer’s behalf. They are also known as payment gateways or payment processors. These services allow merchants to accept cryptocurrency for invoicing and online or in-person payments. This often includes conversion to local fiat currency and settling funds to the merchant's bank account. |

| other named services | All other services named by Chainalysis, including categories of business such as merchant services and gambling. |

| self-hosted | Entities that are most likely controlled by people or private businesses who self-host their cryptocurrency activity in a wallet that they control the private keys for. |

| unnamed services | Entities that exhibit the characteristics of named services, so can be classified with reasonable certainty as a service, but where Chainalysis has not identified the real-world business that controls the blockchain addresses of the entity. Unnamed services are currently only included for bitcoin and Ethereum. |

| protocol privacy | Protocol privacy applies to the two shielded pools built into the Zcash blockchain. |

Self-hosted entities are essentially all entities that have not been identified as services. Some entities included in the self-hosted entity data will be service entities that Chainalysis has not yet identified as services with certainty. This means that data on self-hosted entities is an upper bound while data on all other categories, defi, exchanges, etc., which are composed of services, is a lower bound.

Fast spent entities are self-hosted entities that hold assets for less than 24 hours. This means they receive their first transfer and send their last transfer within 24 hours, and have a zero balance at the start and end of the 24 hours. Fast spent entities are typically created by other entities to manage the transfer of assets so do not represent distinct users. Fast spent entities and their transfers are removed from relevant metrics to better reflect activity between distinct users.

Exchange categories

Exchanges are venues for the buying, selling, and trading of cryptocurrencies. Currently exchanges are the largest cryptocurrency businesses.

Exchanges are grouped into the following categories, depending on the type of assets that can be traded and whether trading is centralized or decentralized:

| Exchange category | Definition |

|---|---|

| all exchanges | The total of all exchanges. |

| crypto-to-crypto exchanges | Venues for the trading of cryptocurrencies primarily for other cryptocurrencies, either via a central limit order book or peer-to-peer via a centralised escrow. |

| crypto-to-fiat exchanges | Venues for the trading of cryptocurrencies primarily for fiat, either via a central limit order book or peer-to-peer via a centralised escrow. |

| derivatives-only exchanges | Venues that only offer the trading of cryptocurrency derivatives via a central limit order book. |

| decentralized exchanges | Venues for the trading of cryptocurrencies via automated smart contracts. Trades on a decentralized platform are peer-to-peer and have no third party or central authority other than the smart contract which executes the trades. |

| other exchanges | All other exchanges not elsewhere classified. |

Illicit entity categories

Cryptocurrency is sometimes used by illicit entities. Currently, the largest illicit entities are darknet markets, scams, and stolen funds.

Illicit entities are grouped into the following categories, depending on the nature of the illicit activity:

| Illicit entity category | Definition |

|---|---|

| darknet markets | Darknet markets are commercial websites that operate on the dark web, which can be accessed via anonymizing browsers or software such as Tor or I2P. These sites function as black markets by selling or advertising illicit goods and services such as drugs, fraud materials, and weapons, among others. Darknet markets use cryptocurrency payment systems, often with escrow services and feedback systems to help develop trust between the vendor and customer. Darknet markets have become more security conscious over the past few years due to multiple law enforcement shutdowns. |

| other illicit entities | Illicit entities other than darknet markets, scams, and stolen funds. These include ransomware and providers of illicit goods and services on platforms other than darknet markets. |

| scams | Scams can impersonate a variety of services, including exchanges, mixers, ICOs, and gambling sites. This category also encompasses scam emails, extortion emails, and fake investment services. They usually offer unrealistic returns on investment, many times trying to mask a pyramid scheme, or pretend to have incriminating personal data on the victim and ask for money in order to not disclose it. |

| stolen funds | Stolen funds comprise instances of hacked exchanges and services. Attackers engage in sophisticated and persistent social engineering, and exploit pre-existing vulnerabilities to transfer funds from exchange hot wallets to their control. The payoff for actors can be enormous with single incidents often resulting in tens of millions of dollars in losses. |

Geographic categories

Cryptocurrency activity can be assigned to geographic regions based on the location of web visitors to a service and combining this with the on-chain flows between services. For example, if service A sends 10 bitcoin to service B, and service A has 50% of its web visits from the USA and service B has 50% of its web visits from the UK, then 25% (50% of 50%) of the 10 bitcoin is sent from the USA to the UK.

This provides an estimate of the geography of cryptocurrency flows, and this estimate is only provided for the flows between services. Services are responsible for the majority of cryptocurrency flows and web visit data is available for thousands of services. As a result, we provide an estimate of the geography of the majority of cryptocurrency flows. Geographic data is not provided for private entities or for cryptocurrency holdings.

Country definitions follow the ISO 3166 standard and countries can be aggregated into sub-regions and regions, which follow the UNSD M49 standard. Flows to unknown are flows to a service that we do not have web visit data for.

Whale categories

A whale is an entity that has held a large amount of assets within its lifetime, that is not a service and is not a fast spent entity (so the entity has held assets for more than 24 hours).

The threshold for the amount of assets that must be held to be a whale varies across cryptocurrencies. The threshold depends on the price of the cryptocurrency at the end of the last calendar year and are described in the table below.

| Price of asset at end of last year | Threshold of assets held to be a whale |

|---|---|

| $10,000+ | 1,000 |

| $10-10,000 | 5,000 |

| <$10 | 1,000,000 |

Whales are grouped into the following categories, depending on when the asset was created.

For assets that were created before 2014:

| Whale category | Definition |

|---|---|

| illiquid pre-2014 whales | Whales that send ¼ to none of the assets they receive, on average over their lifetime, and first held a large amount of assets before 2014 |

| illiquid 2014-2017 whales | Whales that send ¼ to none of the assets they receive, on average over their lifetime, and first held a large amount of assets between 2014 and 2017 |

| illiquid post-2017 whales | Whales that send ¼ to none of the assets they receive, on average over their lifetime, and first held a large amount assets after 2017 |

| liquid pre-2014 whales | Whales that send all to ¼ of the assets they receive, on average over their lifetime, and first held a large amount assets before 2014 |

| liquid 2014-2017 whales | Whales that send all to ¼ of the assets they receive, on average over their lifetime, and first held a large amount assets between 2014 and 2017 |

| liquid post-2017 whales | Whales that send all to ¼ of the assets they receive, on average over their lifetime, and first held a large amount assets before 2017 |

| quick spent whales | Whales that hold assets for less than two weeks. This is regardless of their liquidity or the date they first held a large amount of the asset |

For assets that were created after 2017:

| Whale category | Definition |

|---|---|

| illiquid pre-2017 whales | Whales that send ¼ to none of the assets they receive, on average over their lifetime, and first held a large amount of assets before 2017 |

| illiquid post-2017 whales | Whales that send ¼ to none of the assets they receive, on average over their lifetime, and first held a large amount assets after 2017 |

| liquid pre-2017 whales | Whales that send all to ¼ of the assets they receive, on average over their lifetime, and first held a large amount assets before 2017 |

| liquid post-2017 whales | Whales that send all to ¼ of the assets they receive, on average over their lifetime, and first held a large amount assets before 2017 |

| quick spent whales | Whales that hold assets for less than two weeks. This is regardless of their liquidity or the date they first held a large amount of the asset |

Whales are a different set of entities to entities with wealth above the same threshold in the Wealth metric. In the Wealth metric, entities belong to a wealth bin only when they hold assets within that bin within the time period. An entity belongs to the set of whales if they have ever held assets above the threshold.

So, for example, the Wealth metric group of entities that hold 1,000+ bitcoin gives data on entities that will be in the set of whales, but only gives data in time periods when these entities hold 1,000+ bitcoin. In contrast, metrics for whales give data on entities that have held 1,000+ bitcoin even if they do not hold 1,000+ bitcoin in the time period of the data.

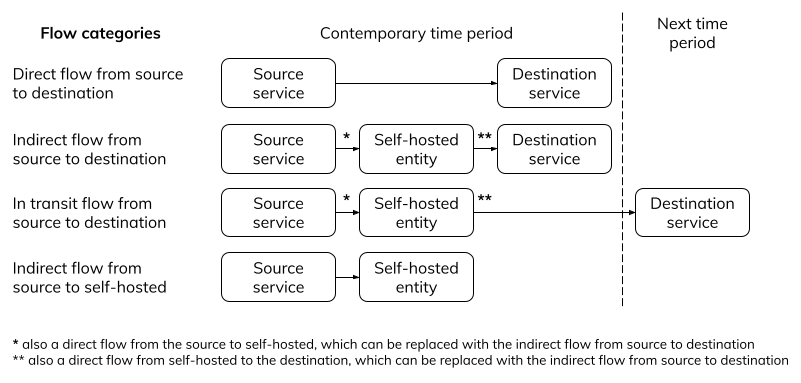

Flow categories

The transfer of assets via the blockchain creates a flow of assets moving between a source and destination.

Flows are measured in connection-based metrics, such as total flows, inter-service flows, and self-hosted service flows. These metrics quantify how entities are connected to businesses by the flow of assets between source and destination services via self-hosted entities.

Flows are grouped into two categories:

- Direct flows: a transfer of assets where the source and destination services are both counterparties to the transfer.

- Indirect flows: a transfer of assets where at least one counterparty to the transfer is a self-hosted entity but where the ultimate source or destination of the transfer is described.

When a service has a direct flow to or from self-hosted entities, this can be replaced with the indirect flow to give the services that are the ultimate source or destination of assets transferred via self-hosted entities. So direct flows excluding flows to/from self-hosted entities plus indirect flows equals the sum of direct flows including flows to/from self-hosted entities. When there is an indirect flow to self-hosted entities this represents assets sent from a source service that have not been received by a destination service by the latest time period, and instead these assets are held by self-hosted entities.

Indirect flows are calculated with no limit to the number of self-hosted entities that assets flow between, thereby providing a complete analysis of how entities are connected to businesses. Some optimisations are made in the calculation that means indirect flows have lower precision than direct flows but this is typically less than 1%.

Flows between services can also be in transit from source to destination services. This is positive when a source has sent assets to a destination but these assets are not received by the destination within the time period - although they will be received prior to the latest time period thereby enabling us to calculate an eventual flow between the source and destination. These assets that have been sent from the source but not yet received by the destination are held by self-hosted entities but are 'in transit' between the source and destination. In transit is negative when the destination receives more assets than the source sends in the time period.

The sum of assets in transit over time between a source and destination equals zero, with some allowance for the lower precision described above. This is because by the current time period all assets must have completed their transit and be received by the destination service. Assets sent from a source service that have not been received by a destination service are described as an indirect flow to self-hosted entities. This quantity typically increases closer to the current time period as the ultimate destination of assets held by self-hosted entities has not yet been chosen by those entities.

Direct, indirect, and in transit flows between a source and destination service, and indirect flows between a source service and self-hosted entities, are described in the diagram below.

Net flows between a source and destination are also provided. This is the asset amount received directly and indirectly by a destination service from a source service, minus the asset amount received directly and indirectly by the source service from the destination service. This is positive when the destination receives more assets than it sends to the source, so the destination is a net receiver. It is negative when the destination sends more assets than it receives from the source, so the destination is a net sender. Net flows are negative when the source and destination are switched, that is to say the net flow from service A to service B is the negative of the net flow from service B to service A.

Numerical accuracy

All metrics are calculated at floating point precision, then exported to four decimal places.

Data delivery

Data structure

Data is delivered via API or CSV flat files delivered to your cloud storage bucket. The API provides the last 365 days of data rolling, while flat files provide the last 365 days of data rolling for Core subscribers, or data for the entire history of an asset since its genesis for Advanced and Premium subscribers.

Two Advanced subscription metrics, the Properties and Whale properties metrics, and all Per service metrics are only delivered via flat file.

Each Market Intel metric is a panel dataset. The panel is composed of dimensions, such as time and in some cases other dimensions such as category, and variables. Variables contain the data of the metric. That is to say each metric contains variables that have data by dimensions, such as over time and by category.

If no value is observed for an entry then the value of the entry is set to zero. That is to say the panel is balanced as empty entries are filled with zeroes. This is the case for all metrics except for the Properties, Whale properties, and Per service metrics, where zeroes are not filled to make delivery of these large datasets more efficient.

Each dimension and variable has a description. Variables also have a time aggregation. This describes the method that should be used to aggregate the variable across time periods.

Data vintages

Our data has vintages. This is because our knowledge of how to aggregate and attribute a blockchain improves over time. For example we attribute a service today, which identifies a set of addresses that have been active far in the past, or we may add new, or improve existing, aggregation algorithms, which aggregate addresses throughout the blockchain. These improvements can be significant as we add tens to hundreds of new services a week and are constantly developing our aggregation algorithms.

The consequence of this is that we may know more about what happens on a particular date at different points in time. For example on the 1 February 2018 we may know more about the entities on the blockchain on 1 January 2018 than we did on 2 January 2018. So as time progresses, we do not just add data for new dates, but we improve all historical data.

Therefore our data has vintages, depending on when it was observed. For example data about 1 January 2018 has a 2 January 2018 vintage and a 1 February 2018 vintage. Another way of describing this is to say that on-chain data is not append-only over time.

Due to this, we update the entire history of each metric every vintage. A new vintage is created with every new time period. For example daily metrics have a new vintage every day. We only provide the latest vintage. So you should always download the entire time series of a metric and not just append the latest time period, and you should analyse metrics from the same vintage.

Data latency

Latency is the time elapsed between the end of a time period and the delivery of data about that time period. Data for most metrics is typically delivered within 6 hours of 23:59:59Z of the time period. Data for more complex metrics is typically delivered within 24 hours of 23:59:59Z of the time period.

We do not provide guarantees on latency. The nature of blockchain data, and our mapping of it to real world activity, mean that unpredictable delays can occur. These rarely significantly affect latency but they make guarantees expensive to maintain.

Latency in our data is a function of the data pipeline that applies Chainalysis' proprietary mapping of blockchain data to real world activity plus the type of calculations that are then applied to this data on real world activity. As our mapping of blockchain data to real world activity is constantly improving, we recalculate the entire history of all our metrics for every data delivery. This adds latency compared to append-only data delivery but it ensures accurate and consistent metrics.

Latency varies by the type of calculations that are applied to the data. These can be grouped into three types:

- Connection-based metrics, which quantify how entities are connected to businesses by the flow of assets between source and destination businesses via self-hosted entities. These metrics typically have 24 hours latency, as we trace how entities are connected to services through the entire history of the blockchain for every daily data delivery.

- Properties-based metrics, which quantify the behaviour of every entity on the blockchain, for example their age, gain, liquidity, and wealth. These metrics typically have 24 hours latency, as we recalculate properties for every entity through the entire history of the blockchain for every data delivery, which is currently weekly.

- Transfer-based metrics, which quantify the transfers in and out, and balance, of entities. These metrics typically have low latency, delivered within a few hours at most but often within minutes.

Flat file authentication

AWS S3

To set up permissions:

- Create a new bucket with a unique name, for example:

chainalysis-markets-your-organisation-name - Leave all properties on default, and select your preferred location

- After creating the bucket, navigate to its

Permissionstab,Access control list (ACL)section and clickEdit - Under

Access for other AWS accountsclickAdd Grantee - Add grantee with our canonical ID:

(provided by the customer success team), and check all the boxes:Objects: List, WriteandBucket ACL: Read, Write, then clickSave changes - Share the bucket name used in the first step with Chainalysis, and you are all set up.

Google Cloud Storage

To set up permissions:

- Create a new bucket with a unique name, for example:

chainalysis-markets-your-organisation-name - Leave all properties on default, and select your preferred location

- After creating the bucket, navigate to its

Permissionstab and clickAdd - Under

New principalsadd the Chainalysis service account and from underSelect a role > Cloud Storageselect theStorage Object Admin, this is the minimal role which allows us to write and update data in the bucket. - Save and share the bucket name used in the first step with Chainalysis, and you are all set up.

Other cloud providers

Please contact us at marketintel@chainalysis.com.

API authentication

To authorize, use this code:

# With shell, you can just pass the correct header with each request

curl "https://api.markets.chainalysis.com/v1/{category}/{metric}?asset={asset}"

-H "token: 948cf07be9c989d637"

Make sure to replace

948cf07be9c989d637with your API key.

The Market Intel API expects your API key to be included in all API requests to the server in a header that looks like the following:

Token: 948cf07be9c989d637

API errors

The Market Intel API uses the following error codes:

| Error Code | Meaning |

|---|---|

| 400 Bad Request | Your request is invalid. |

| 401 Unauthorized | Your API key is wrong. |

| 403 Forbidden | API endpoint unavailable for you. |

| 429 Too Many Requests | You've made too many requests. |

| 500 Internal Server Error | We had a problem with our server. Try again later. |

| 503 Service Unavailable | We're temporarily offline for maintenance. Please try again later. |

Demand

How cryptocurrency is used. Our demand metrics describe how assets are sent and received between different types of users, businesses, and geographic regions.

Total flows

curl "https://api.markets.chainalysis.com/v1/demand/total-flows?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-05-29",

"source_category": "unnamed services",

"destination_category": "other exchanges",

"asset_amount": 237.8603,

"usd_amount": 6936184.5624

},

{

"time": "2022-03-23",

"source_category": "defi",

"destination_category": "crypto-to-fiat exchanges",

"asset_amount": 0.0,

"usd_amount": 0.0734

}

]

Relevance

People and businesses transfer assets on the blockchain for different use cases, for example to trade, invest, or purchase goods and services. These flows show the overall level of asset use and how assets flow between use cases. Most flows on the blockchain are assets in transit between services, moving via self-hosted entities.

Definition

The value of assets transferred on the blockchain between types of entity. Entities are businesses, such as exchanges, and transfers via self-hosted entities, often in transit to services. Self-hosted entities are typically people and private businesses who self-host their cryptocurrency activity in a wallet that they control the private keys for.

Dimensions

| Dimension | Description |

|---|---|

| time | Daily time period For weekly time period use total-flows-weekly For monthly time period use total-flows-monthly |

| source_category | Source entity |

| destination_category | Destination entity |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| asset_amount | Asset amount transferred between types of entity | Use metric: total-flows-weekly or total-flows-monthly |

| usd_amount | USD amount transferred between types of entity | Use metric: total-flows-weekly or total-flows-monthly |

Notes

The transfer of assets between fast spent entities, entities that hold assets for less than 24 hours, is excluded from this metric.

The total flows sourced from a category of services and sent to all service categories and self-hosted destinations is equal to the total outflow from the source category.

The total flows destined to a category of services received from all service category sources but excluding flows from self-hosted sources is equal to the total inflow to the destination category.

Inter category flows

curl "https://api.markets.chainalysis.com/v1/demand/inter-category-flows?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-03-31",

"source_category": "unnamed services",

"destination_category": "decentralized exchanges",

"asset_amount_direct": 0.0,

"asset_amount_indirect": 0.1643,

"asset_amount_in_transit": 0.0486,

"asset_amount_net": 0.1602,

"usd_amount_direct": 0.0,

"usd_amount_indirect": 7777.4437,

"usd_amount_in_transit": 2206.6467,

"usd_amount_net": 7292.8952

},

{

"time": "2022-04-29",

"source_category": "merchant services",

"destination_category": "merchant services",

"asset_amount_direct": 1.7362,

"asset_amount_indirect": 97.7602,

"asset_amount_in_transit": 118.8641,

"asset_amount_net": 0.0,

"usd_amount_direct": 66565.8152,

"usd_amount_indirect": 3824117.0719,

"usd_amount_in_transit": 4646521.107,

"usd_amount_net": 0.0

}

]

Relevance

Cryptocurrency is transferred between businesses as customers switch to providers with more competitive offerings, or traders balance assets across venues, or businesses make payments to other businesses to cover the costs of the goods and services they provide.

As inter category flows describes the source of inflows and the destination of outflows for categories of services, it quantifies which categories of businesses are succeeding and the consequences of this for competing categories of businesses. For example flows to crypto-to-fiat exchanges from crypto-to-crypto exchanges suggest people are interested in cashing out to fiat, while flows from exchanges to DeFi suggest people are interested in the broader set of opportunities typically available in DeFi relative to exchanges.

Definition

The amount of assets transferred via the blockchain between categories of services. Inter category flows describes the categories of services that are the source of inflows to a category of service and the category of services that are the destination of outflows from a category of service.

Direct flows between categories of services and counterparties are provided, plus indirect flows between categories of services when the direct counterparty is self-hosted.

The flow that is in transit between a source and destination category describes the difference within a time period of assets sent by the source to the destination versus assets received by the destination from the source. The difference is assets currently held by self-hosted entities that were sourced from the source category and are destined to be received by the destination category.

Net flows between a source and destination are also provided. The net flow is the direct plus indirect flow between a source and destination.

The flow categories are described in more detail here.

Dimensions

| Dimension | Description |

|---|---|

| time | Daily time period |

| source_category | Source category |

| destination_category | Destination category |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| asset_amount_direct | Asset amount received directly from source | Sum |

| asset_amount_indirect | Asset amount received indirectly from source | Sum |

| asset_amount_in_transit | Asset amount in transit from source to destination | Sum |

| usd_amount_direct | USD amount received directly from source | Sum |

| usd_amount_indirect | USD amount received indirectly from source | Sum |

| usd_amount_in_transit | USD amount in transit from source to destination | Sum |

| asset_amount_net | Net asset amount transferred between source and destination | Sum |

| usd_amount_net | Net USD amount transferred between source and destination | Sum |

Notes

This metric is only delivered via flat file.

Inter category flows provides more detail on the flow categories compared to total flows, but inter category flows excludes self-hosted to self-hosted flows that are included in total flows.

Self-hosted category flows

curl "https://api.markets.chainalysis.com/v1/demand/self-hosted-category-flows?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-05-22",

"category": "merchant services",

"asset_flow_sourced": 537.0904,

"asset_flow_destined": 712.3561,

"transfers_sourced": 29852,

"transfers_destined": 58548,

"usd_flow_sourced": 15996664.1714,

"usd_flow_destined": 21151423.23

},

{

"time": "2022-05-17",

"category": "crypto-to-fiat exchanges",

"asset_flow_sourced": 176609.0085,

"asset_flow_destined": 51992.1083,

"transfers_sourced": 272615,

"transfers_destined": 162646,

"usd_flow_sourced": 5330718705.5924,

"usd_flow_destined": 1566347357.2749

}

]

Relevance

Most flows on the blockchain are assets in transit between services, moving via self-hosted entities.

Self-hosted category flows describes the categories of services that these self-hosted flows were ultimately sourced from or are ultimately destined to. This quantifies which categories of businesses are ultimately generating the largest amount of activity on the blockchain, outside of their platforms.

Definition

The amount of assets transferred via the blockchain between self-hosted entities, described by the category of service that the assets were ultimately sourced from or are ultimately destined to. Self-hosted entities are typically people and private businesses who self-host their cryptocurrency activity in a wallet that they control the private keys for.

Dimensions

| Dimension | Description |

|---|---|

| time | Daily time period |

| category | Entity category |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| asset_flow_sourced | Flow of assets sourced from category via transfers between self-hosted entities | Sum |

| asset_flow_destined | Flow of assets destined to category via transfers between self-hosted entities | Sum |

| usd_flow_sourced | USD value of flow of assets sourced from category via transfers between self-hosted entities | Sum |

| usd_flow_destined | USD value of flow of assets destined to category via transfers between self-hosted entities | Sum |

| transfers_sourced | Number of transfers between self-hosted entities for assets sourced from category | Sum |

| transfers_destined | Number of transfers between self-hosted entities for assets destined to category | Sum |

Notes

The transfer of assets between fast spent entities, entities that hold assets for less than 24 hours, is currently included in this metric. This is in contrast to the total flows metric, where these are removed.

Country flows

curl "https://api.markets.chainalysis.com/v1/demand/country-flows?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-03-15",

"source_country_name": "Tajikistan",

"source_country_code": "TJK",

"source_region": "Asia",

"source_sub_region": "Central Asia",

"destination_country_name": "Nicaragua",

"destination_country_code": "NIC",

"destination_region": "Americas",

"destination_sub_region": "Latin America and the Caribbean",

"asset_amount_direct": 0.0002,

"asset_amount_indirect": 0.0004,

"asset_amount_net": 0.0,

"usd_amount_direct": 6.9845,

"usd_amount_indirect": 16.8865,

"usd_amount_net": -0.9501

},

{

"time": "2022-04-21",

"source_country_name": "Saint Lucia",

"source_country_code": "LCA",

"source_region": "Americas",

"source_sub_region": "Latin America and the Caribbean",

"destination_country_name": "R\u00e9union",

"destination_country_code": "REU",

"destination_region": "Africa",

"destination_sub_region": "Sub-Saharan Africa",

"asset_amount_direct": 0.002,

"asset_amount_indirect": 0.0428,

"asset_amount_net": 0.0005,

"usd_amount_direct": 84.6855,

"usd_amount_indirect": 1781.3249,

"usd_amount_net": 19.3654

}

]

Relevance

Assets flow within and between countries as customers of businesses in one country transfer assets to businesses used by customers in other countries. Flows of assets between countries reflect differences in demand, or responses to regulatory concerns, geopolitical changes, or significant market price variations.

Definition

An estimate of the value of assets transferred on the blockchain between countries, based on the location of web visitors to services and the on-chain flows between these services.

Dimensions

| Dimension | Description |

|---|---|

| time | Daily time period |

| source_country_name | Source country name |

| source_country_code | Source country Alpha-3 code |

| source_region | Source region |

| source_sub_region | Source sub-region |

| destination_country_name | Destination country name |

| destination_country_code | Destination country Alpha-3 code |

| destination_region | Destination region |

| destination_sub_region | Destination sub-region |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| asset_amount_direct | Asset amount received directly from source | Sum |

| asset_amount_indirect | Asset amount received indirectly from source | Sum |

| asset_amount_net | Net asset amount transferred between source and destination | Sum |

| usd_amount_direct | USD amount received directly from source | Sum |

| usd_amount_indirect | USD amount received indirectly from source | Sum |

| usd_amount_net | Net USD amount transferred between source and destination | Sum |

Notes

Not all cryptocurrency flows can be assigned a country, so the country flows metric provides a lower bound. Flows to unknown are flows to a service that we do not have web visit data for.

Regional flows

curl "https://api.markets.chainalysis.com/v1/demand/regional-flows?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-04-24",

"source_region": "Oceania",

"source_sub_region": "Australia and New Zealand",

"destination_region": "Europe",

"destination_sub_region": "Southern Europe",

"asset_amount_direct": 6.3371,

"asset_amount_indirect": 4.1554,

"asset_amount_net": 1.0628,

"usd_amount_direct": 250933.5098,

"usd_amount_indirect": 164591.1504,

"usd_amount_net": 41955.0289

},

{

"time": "2022-04-21",

"source_region": "Unknown",

"source_sub_region": "Unknown",

"destination_region": "Africa",

"destination_sub_region": "Sub-Saharan Africa",

"asset_amount_direct": 597.8436,

"asset_amount_indirect": 27.4138,

"asset_amount_net": 44.9404,

"usd_amount_direct": 24923305.7381,

"usd_amount_indirect": 1140748.6307,

"usd_amount_net": 1821567.0337

}

]

Relevance

Assets flow within and between geographic regions as customers of businesses in one region transfer assets to businesses used by customers in other regions. Flows of assets between regions reflect differences in demand, or responses to regulatory concerns, geopolitical changes, or significant market price variations.

Definition

An estimate of the value of assets transferred on the blockchain between geographic regions, based on the location of web visitors to services and the on-chain flows between these services.

Dimensions

| Dimension | Description |

|---|---|

| time | Daily time period |

| source_region | Source region |

| source_sub_region | Source sub-region |

| destination_region | Destination region |

| destination_sub_region | Destination sub-region |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| asset_amount_direct | Asset amount received directly from source | Sum |

| asset_amount_indirect | Asset amount received indirectly from source | Sum |

| asset_amount_net | Net asset amount transferred between source and destination | Sum |

| usd_amount_direct | USD amount received directly from source | Sum |

| usd_amount_indirect | USD amount received indirectly from source | Sum |

| usd_amount_net | Net USD amount transferred between source and destination | Sum |

Notes

Not all cryptocurrency flows can be assigned a region, so the regional flows metric provides a lower bound. Flows to unknown are flows to a service that we do not have web visit data for.

Regional category flows

curl "https://api.markets.chainalysis.com/v1/demand/regional-category-flows?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-05-11",

"source_category": "merchant services",

"source_region": "Asia",

"source_sub_region": "Western Asia",

"destination_category": "merchant services",

"destination_region": "Europe",

"destination_sub_region": "Northern Europe",

"asset_amount_direct": 0.004,

"asset_amount_indirect": 2.2945,

"asset_amount_net": -0.0056,

"usd_amount_direct": 124.9083,

"usd_amount_indirect": 72600.7583,

"usd_amount_net": -161.7116

},

{

"time": "2022-03-27",

"source_category": "high risk jurisdiction",

"source_region": "Europe",

"source_sub_region": "Southern Europe",

"destination_category": "gambling",

"destination_region": "Asia",

"destination_sub_region": "Western Asia",

"asset_amount_direct": 0.0,

"asset_amount_indirect": 0.0,

"asset_amount_net": 0.0,

"usd_amount_direct": 0.0,

"usd_amount_indirect": 0.0006,

"usd_amount_net": -0.0231

}

]

Relevance

Assets flow between categories of businesses in different geographic regions as customers of a category of business in one region transfer assets to a different category of business used by customers in other regions. Flows of assets between the combination of categories and regions reflect differences in demand for types of businesses or demand between countries, or responses to regulatory concerns, geopolitical changes, or significant market price variations.

Definition

An estimate of the value of assets transferred on the blockchain between categories of services in geographic regions, based on the location of web visitors to services and the on-chain flows between these services.

Dimensions

| Dimension | Description |

|---|---|

| time | Daily time period |

| source_category | Source category |

| source_region | Source region |

| source_sub_region | Source sub-region |

| destination_category | Destination category |

| destination_region | Destination region |

| destination_sub_region | Destination sub-region |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| asset_amount_direct | Asset amount received directly from source | Sum |

| asset_amount_indirect | Asset amount received indirectly from source | Sum |

| asset_amount_net | Net asset amount transferred between source and destination | Sum |

| usd_amount_direct | USD amount received directly from source | Sum |

| usd_amount_indirect | USD amount received indirectly from source | Sum |

| usd_amount_net | Net USD amount transferred between source and destination | Sum |

Notes

Not all cryptocurrency flows can be assigned a region, so the regional flows metric provides a lower bound. Flows to unknown are flows to a service that we do not have web visit data for.

Supply

How cryptocurrency is held. Our supply metrics describe the age, USD cost and gain, liquidity, and wealth of cryptocurrency holders, and the assets they send and receive.

Age

curl "https://api.markets.chainalysis.com/v1/supply/age?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-03-14",

"group": "[2, 52)",

"assets_held": 7121738.4197,

"assets_sent": 297090.0699,

"assets_received": 242147.9948,

"entities_held": 12265561,

"entities_sent": 48614,

"entities_received": 118905,

"transfers_sent": 399795,

"transfers_received": 1217289,

"total_held": 160617163.6983,

"total_sent": 2791424.0051,

"total_received": 2161096.3436

},

{

"time": "2022-02-14",

"group": "[0, 2)",

"assets_held": 319576.3312,

"assets_sent": 630178.615,

"assets_received": 585201.7197,

"entities_held": 633460,

"entities_sent": 476174,

"entities_received": 857897,

"transfers_sent": 2261327,

"transfers_received": 3071836,

"total_held": 406637.6227,

"total_sent": 389684.3179,

"total_received": 579524.4572

}

]

Relevance

Age is the amount of time an asset is held by an entity.

The amount of assets held, sent and received by entities of different age describes the properties of holders of supply. For example, if the majority of assets have been held for a long time then holders are likely using the asset as a store of value, or when assets are sent by entities that have held those assets for a long time then it suggests long term holders are losing conviction in the asset.

Definition

The number of weeks an entity has held assets on average, across all addresses controlled by the entity, weighted by the amount of assets received and sent over time.

Dimensions

| Dimension | Description |

|---|---|

| time | Weekly time period |

| group | Age group (in weeks) |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| assets_held | Amount of assets held | Average |

| assets_sent | Amount of assets sent | Sum |

| assets_received | Amount of assets received | Sum |

| entities_held | Number of entities holding | Average |

| entities_sent | Number of entities sending | Average |

| entities_received | Number of entities receiving | Average |

| transfers_sent | Number of transfers sent | Sum |

| transfers_received | Number of transfers received | Sum |

| total_held | Total age of assets held (asset amount * weeks) | Average |

| total_sent | Total age of assets sent (asset amount * weeks) | Sum |

| total_received | Total age of assets received (asset amount * weeks) | Sum |

Notes

Data is grouped into the following groups (units are weeks): [0, 2), [2, 4), [4, 13), [13, 26), [26, 52), [52, 78), [78, 104), [104, 156), [156, 208), [208, 260), [260, 312), [312, 364), [364, 416), [416, 468), [468, 520), [520, 572), 572+.

That is to say group [0, 2) contains data on entities that have held assets for a weighted average of more than or equal to 0 weeks and strictly less than 2 weeks.

Groups are truncated for more recent assets, that is to say an asset that has not existed for more than 260 weeks will only have groups up to and including [208, 260) weeks.

The weighted average age of holdings across groups can be calculated (within a time period) by summing, across groups, total_held and, separately, assets_held, then dividing the sum of total_held by the sum of assets_held. This can be applied equivalently to sent and received variables.

The age of assets sent is the age of assets held by the entities that send assets in a time period, while the age of assets received is the age of the assets held by the entities that receive assets in a time period. So comparing the groups that send versus receive indicates how the properties of the supply are changing.

Fast spent entities, entities that hold assets for less than 24 hours, are excluded from this metric.

Data is weekly, so it contains data generated between 00:00:00Z on a Monday and ends at 23:59:59Z on a Sunday. Variables that describe a flow, such as assets sent or received, give data on the flow occurring between the start and the end of the week. For example, data for the week of 2020-01-06 describes the assets sent or received between 2020-01-06T00:00:00Z and 2020-01-12T23:59:59Z. Variables that describe a state, such as assets held, give data on the state at the end of the week. For example, data for the week of 2020-01-06 describes the assets held as of 2020-01-12T23:59:59Z.

Gain

curl "https://api.markets.chainalysis.com/v1/supply/gain?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2021-12-27",

"group": "[-25, -5)%",

"assets_held": 3128152.5463,

"assets_sent": 195684.2601,

"assets_received": 123828.5189,

"entities_held": 4506991,

"entities_sent": 105249,

"entities_received": 129396,

"transfers_sent": 369539,

"transfers_received": 784267,

"total_usd_cost_held": 175380214521.9117,

"total_usd_cost_sent": 10531642445.4468,

"total_usd_cost_received": 6470702178.8939,

"total_usd_value_held": 150211066977.0377,

"total_usd_value_sent": 9396581868.1386,

"total_usd_value_received": 5946133916.9809

},

{

"time": "2022-01-03",

"group": "100%+",

"assets_held": 9637329.5905,

"assets_sent": 27152.6562,

"assets_received": 892.7276,

"entities_held": 22128505,

"entities_sent": 15976,

"entities_received": 2849,

"transfers_sent": 25798,

"transfers_received": 4062,

"total_usd_cost_held": 48098388382.0114,

"total_usd_cost_sent": 306195905.62,

"total_usd_cost_received": 13250829.7492,

"total_usd_value_held": 424747290891.9941,

"total_usd_value_sent": 1196702579.5733,

"total_usd_value_received": 39345301.0471

}

]

Relevance

Gain is the USD gain or loss of assets held by an entity, comparing the current USD value of the assets to the value when the entity received them.

The amount of assets held, sent and received by entities with different levels of USD gain describes the properties of holders of supply. For example, if there is an increase in assets held by entities with a large USD gain then these assets may soon be sold to realize the gain, potentially lowering prices, or when assets are sent by entities with a large loss then it suggests that holders are accepting losses and exiting the market.

Definition

Cost is the weighted average USD value of assets when received by an entity, accounting for assets sent, across all addresses controlled by the entity.

Gain is the cost relative to current price.

Dimensions

| Dimension | Description |

|---|---|

| time | Weekly time period |

| group | USD gain group (in % USD gain or loss) |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| assets_held | Amount of assets held | Average |

| assets_sent | Amount of assets sent | Sum |

| assets_received | Amount of assets received | Sum |

| entities_held | Number of entities holding | Average |

| entities_sent | Number of entities sending | Average |

| entities_received | Number of entities receiving | Average |

| transfers_sent | Number of transfers sent | Sum |

| transfers_received | Number of transfers received | Sum |

| total_usd_cost_held | Total USD cost of assets held (asset amount * cost) | Average |

| total_usd_cost_sent | Total USD cost of assets received (asset amount * cost) | Sum |

| total_usd_cost_received | Total USD cost of assets sent (asset amount * cost) | Sum |

| total_usd_value_held | Total USD value of assets held (asset amount * price) | Average |

| total_usd_value_sent | Total USD value of assets received (asset amount * price) | Sum |

| total_usd_value_received | Total USD value of assets sent (asset amount * price) | Sum |

Notes

Data is grouped in the following groups: (units are %): [-100, -75), [-75, -50), [-50, -25), [-25, -5), [-5, 0), [0, 5), [5, 25), [25, 50), [50, 75), [75, 100), [100, 1000), 1000+.

That is to say group [-100, -75) contains data on entities that have experienced a 100% to 75% USD loss on the current value of their assets relative to value when they received their assets.

For stablecoins, data is grouped in the following bins (units are %): <-1, [-1, -0.1), [-0.1, 0), [0, 0.1), [0.1, 1), 1+.

The weighted average cost of holdings across groups can be calculated (within a time period) by summing, across groups, total_usd_cost_held and, separately, assets_held, then dividing the sum of total_usd_cost_held by the sum of assets_held. This can be applied equivalently to sent and received variables. It can also be applied equivalently for the average gain, using total_usd_value_held minus total_usd_cost_held.

The weighted average gain of holdings across groups can be calculated (within a time period) by summing, across groups, total_usd_value_held minus total_usd_cost_held and, separately, assets_held, then dividing the sum of total_usd_value_held minus total_usd_cost_held by the sum of assets_held. This can be applied equivalently to sent and received variables.

Fast spent entities, entities that hold assets for less than 24 hours, are excluded from this metric.

The cost and gain of assets sent is the cost and gain of assets held by the entities that send assets in a time period, while the cost and gain of assets received is the cost and gain of the assets held by the entities that receive assets in a time period. So comparing the groups that send versus receive indicates how the properties of the supply are changing.

Data is weekly, so it contains data generated between 00:00:00Z on a Monday and ends at 23:59:59Z on a Sunday. Variables that describe a flow, such as assets sent or received, give data on the flow occurring between the start and the end of the week. For example, data for the week of 2020-01-06 describes the assets sent or received between 2020-01-06T00:00:00Z and 2020-01-12T23:59:59Z. Variables that describe a state, such as assets held, give data on the state at the end of the week. For example, data for the week of 2020-01-06 describes the assets held as of 2020-01-12T23:59:59Z.

Liquidity

curl "https://api.markets.chainalysis.com/v1/supply/liquidity?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2021-12-27",

"group": "Highly liquid",

"assets_held": 1595559.6682,

"assets_sent": 552576.0506,

"assets_received": 548740.9945,

"entities_held": 2988423,

"entities_sent": 231558,

"entities_received": 237064,

"transfers_sent": 1609155,

"transfers_received": 2806115,

"total_held": 1504203.5094,

"total_sent": 535847.5719,

"total_received": 531869.5176

},

{

"time": "2022-03-07",

"group": "Liquid",

"assets_held": 1833810.8737,

"assets_sent": 303599.1137,

"assets_received": 117638.3201,

"entities_held": 770816,

"entities_sent": 135761,

"entities_received": 71536,

"transfers_sent": 530186,

"transfers_received": 535612,

"total_held": 1185478.744,

"total_sent": 179053.4658,

"total_received": 79684.4376

}

]

Relevance

Liquidity is the likelihood that an entity sends on assets it receives or continues to hold them. Illiquid entities act as sinks, reducing the number of assets available to buy, so can be characterised as investors. Liquid and highly liquid entities are sources, as their assets keep circulating, so can be characterised as traders.

The amount of assets held, sent and received by entities of different liquidity describes the properties of holders of supply. For example, if there is an increase in assets held by liquid entities then there is an increase in the assets available to buy, potentially lowering prices, or when assets are sent by illiquid entities then it suggests that investors are reducing their positions.

Definition

The average ratio of net to gross flows of assets of an entity over the lifetime of the entity, across all addresses controlled by the entity.

A highly liquid entity sends on average all to ⅔ of the assets it receives, a liquid entity sends ⅔ to ¼ of the assets it receives, and an illiquid entity sends ¼ to none of the assets it receives.

Dimensions

| Dimension | Description |

|---|---|

| time | Weekly time period |

| group | Liquidity group (highly liquid, liquid, or illiquid) |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| assets_held | Amount of assets held | Average |

| assets_sent | Amount of assets sent | Sum |

| assets_received | Amount of assets received | Sum |

| entities_held | Number of entities holding | Average |

| entities_sent | Number of entities sending | Average |

| entities_received | Number of entities receiving | Average |

| transfers_sent | Number of transfers sent | Sum |

| transfers_received | Number of transfers received | Sum |

| total_held | Total liquidity of assets held (asset amount * liquidity, where 0 is fully illiquid, 1 is fully liquid) | Average |

| total_sent | Total liquidity of assets sent (asset amount * liquidity, where 0 is fully illiquid, 1 is fully liquid) | Sum |

| total_received | Total liquidity of assets received (asset amount * liquidity, where 0 is fully illiquid, 1 is fully liquid) | Sum |

Notes

Liquidity is calculated per entity as 1 minus the average ratio of net to gross flows, averaged over the lifetime of the entity.

Liquidity is measured between 0 and 1. A measure of 0 shows that an asset is completely illiquid, as this occurs only if assets are never sent once they are generated. A measure of 1 shows that an asset is completely liquid, as this occurs only if all assets that are received are immediately sent.

A highly liquid entity sends on average all to ⅔ of the assets it receives. This is equal to a liquidity value of 1 to 0.8.

A liquid entity sends ⅔ to ¼ of the assets it receives. This is equal to a liquidity value of 0.8 to 0.4.

An illiquid entity sends ¼ to none of the assets it receives. This is equal to a liquidity value of 0.4 to 0.

The weighted average liquidity of holdings across groups can be calculated (within a time period) by summing, across groups, total_held and, separately, assets_held, then dividing the sum of total_held by the sum of assets_held. This can be applied equivalently to sent and received variables.

The liquidity of assets sent is the liquidity of assets held by the entities that send assets in a time period, while the liquidity of assets received is the liquidity of the assets held by the entities that receive assets in a time period. So comparing the groups that send versus receive indicates how the properties of the supply are changing.

Fast spent entities, entities that hold assets for less than 24 hours, are excluded from this metric.

Data is weekly, so it contains data generated between 00:00:00Z on a Monday and ends at 23:59:59Z on a Sunday. Variables that describe a flow, such as assets sent or received, give data on the flow occurring between the start and the end of the week. For example, data for the week of 2020-01-06 describes the assets sent or received between 2020-01-06T00:00:00Z and 2020-01-12T23:59:59Z. Variables that describe a state, such as assets held, give data on the state at the end of the week. For example, data for the week of 2020-01-06 describes the assets held as of 2020-01-12T23:59:59Z.

Wealth

curl "https://api.markets.chainalysis.com/v1/supply/wealth?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-02-14",

"group": "[100, 1k)",

"assets_held": 3802018.2542,

"assets_sent": 89400.2609,

"assets_received": 124513.4366,

"entities_held": 13186,

"entities_sent": 241,

"entities_received": 540,

"transfers_sent": 356852,

"transfers_received": 745379

},

{

"time": "2022-03-14",

"group": "[1k, 10k)",

"assets_held": 4604603.3208,

"assets_sent": 86828.1784,

"assets_received": 284993.9378,

"entities_held": 2072,

"entities_sent": 83,

"entities_received": 182,

"transfers_sent": 99054,

"transfers_received": 80403

}

]

Relevance

Wealth is the amount of an asset held by an entity, that is the balance of the entity.

The amount of assets held, sent and received by entities with different levels of wealth describes the properties of holders of supply. For example, if there is an increase in assets held by wealthy entities then this indicates that institutions are acquiring the asset, or when assets are sent by entities with low wealth then it suggests retail investors are selling.

Definition

The amount of an asset held by an entity, across all addresses controlled by the entity. That is to say the balance of an entity.

Dimensions

| Dimension | Description |

|---|---|

| time | Weekly time period |

| group | Wealth group (in asset amount held) |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| assets_held | Amount of assets held | Average |

| assets_sent | Amount of assets sent | Sum |

| assets_received | Amount of assets received | Sum |

| entities_held | Number of entities holding | Average |

| entities_sent | Number of entities sending | Average |

| entities_received | Number of entities receiving | Average |

| transfers_sent | Number of transfers sent | Sum |

| transfers_received | Number of transfers received | Sum |

Notes

Data is grouped in the following groups (units are assets held): [0, 0.1), [0.1, 1), [1, 10), [10, 100), [100, 1k), [1k, 10k), 10k+.

That is to say group [0, 0.1) contains data on entities that hold more than or equal to 0 of the asset and strictly less than 0.1 of the asset.

For stablecoins, data is grouped in the following bins (units are assets held): [0, 1), [1, 100), [100, 1k), [1k, 10k), [10k, 100k), [100k, 1M), [1M, 10M), 10M+.

k represents thousands, so 1k is 1,000. M represents millions, so 1M is 1,000,000.

The weighted average holdings across groups can be calculated (within a time period) by summing, across groups, assets_held and, separately, entities_held, then dividing the sum of assets_held by the sum of entities_held. This can be applied equivalently to sent and received variables.

The wealth of sending entities is the wealth of entities that send assets in a time period, while the wealth of receiving entities is the wealth of entities that receive assets in a time period. So comparing the groups that send versus receive indicates how the properties of the supply are changing.

Fast spent entities, entities that hold assets for less than 24 hours, are excluded from this metric.

Data is weekly, so it contains data generated between 00:00:00Z on a Monday and ends at 23:59:59Z on a Sunday. Variables that describe a flow, such as assets sent or received, give data on the flow occurring between the start and the end of the week. For example, data for the week of 2020-01-06 describes the assets sent or received between 2020-01-06T00:00:00Z and 2020-01-12T23:59:59Z. Variables that describe a state, such as assets held, give data on the state at the end of the week. For example, data for the week of 2020-01-06 describes the assets held as of 2020-01-12T23:59:59Z.

Properties

curl "https://api.markets.chainalysis.com/v1/supply/properties?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-02-21",

"category": "self-hosted",

"age_group": "[520, 572)",

"gain_group": "1000+",

"liquidity_group": "highly liquid",

"wealth_group": "[0, 0.1)",

"assets_held": 52.1608,

"assets_sent": 0.0,

"assets_received": 0.0,

"entities_held": 3331,

"entities_sent": 0,

"entities_received": 0,

"transfers_sent": 0,

"transfers_received": 0,

"total_age_held": 28544.8819,

"total_age_sent": 0.0,

"total_age_received": 0.0,

"total_liquidity_held": 49.8199,

"total_liquidity_sent": 0.0,

"total_liquidity_received": 0.0,

"total_usd_cost_held": 579.103,

"total_usd_cost_sent": 0.0,

"total_usd_cost_received": 0.0,

"total_usd_value_held": 1990207.7199,

"total_usd_value_sent": 0.0,

"total_usd_value_received": 0.0

},

{

"time": "2022-02-21",

"category": "self-hosted",

"age_group": "[52, 78)",

"gain_group": "[-25, -5)",

"liquidity_group": "illiquid",

"wealth_group": "[0.1, 1)",

"assets_held": 18422.8548,

"assets_sent": 7.3039,

"assets_received": 0.0827,

"entities_held": 58154,

"entities_sent": 15,

"entities_received": 10,

"transfers_sent": 18,

"transfers_received": 12,

"total_age_held": 999007.6913,

"total_age_sent": 394.6798,

"total_age_received": 4.4824,

"total_liquidity_held": 60.1351,

"total_liquidity_sent": 0.1731,

"total_liquidity_received": 0.0018,

"total_usd_cost_held": 865228623.5536,

"total_usd_cost_sent": 330092.7025,

"total_usd_cost_received": 3377.407,

"total_usd_value_held": 702927815.7875,

"total_usd_value_sent": 278682.1575,

"total_usd_value_received": 3155.8743

}

]

Relevance

Properties describes entities by the combination of their category, age, gain, liquidity, and wealth. For example it describes the amount of assets held by self-hosted entities that are 2 to 4 weeks old, have experienced a 10 to 25% USD gain, are illiquid, and have a balance of 10 to 100 units of the asset.

This combination of the age, gain, liquidity, and wealth metrics gives a more detailed description of the holders of supply than separately considering their age, or gain, or liquidity, or wealth. For example, it can be used to analyse the amount of cryptocurrency acquired over time by self-hosted investors of different wealth and age groups and their cost of acquisition, which indicates the level of demand at different price levels.

Definition

Properties is the joint distribution of variables across the four dimensions of age, gain, liquidity and wealth.

Age is the number of weeks an entity has held assets on average, across all addresses controlled by the entity, weighted by the amount of assets received and sent over time.

Gain is the weighted average USD value of assets when received by an entity relative to current price, accounting for assets sent, across all addresses controlled by the entity.

Liquidity is the average ratio of net to gross flows of assets of an entity over the lifetime of the entity, across all addresses controlled by the entity. A highly liquid entity sends on average all to ⅔ of the assets it receives, a liquid entity sends ⅔ to ¼ of the assets it receives, and an illiquid entity sends ¼ to none of the assets it receives.

Wealth is the amount of an asset held by an entity, across all addresses controlled by the entity. That is to say the balance of an entity.

Dimensions

| Dimension | Description |

|---|---|

| time | Weekly time period |

| category | Entity category |

| age_group | Age group (in weeks) |

| gain_group | USD gain group (in % USD gain or loss) |

| liquidity_group | Liquidity group (highly liquid, liquid, or illiquid) |

| wealth_group | Wealth group (in asset amount held) |

Variables

| Variable | Description | Time aggregation |

|---|---|---|

| assets_held | Amount of assets held | Average |

| assets_sent | Amount of assets sent | Sum |

| assets_received | Amount of assets received | Sum |

| entities_held | Number of entities holding | Average |

| entities_sent | Number of entities sending | Average |

| entities_received | Number of entities receiving | Average |

| transfers_sent | Number of transfers sent | Sum |

| transfers_received | Number of transfers received | Sum |

| total_age_held | Total age of assets held (asset amount * weeks) | Average |

| total_age_sent | Total age of assets sent (asset amount * weeks) | Sum |

| total_age_received | Total age of assets received (asset amount * weeks) | Sum |

| total_liquidity_held | Total liquidity of assets held (asset amount * liquidity, where 0 is fully illiquid, 1 is fully liquid) | Average |

| total_liquidity_sent | Total liquidity of assets sent (asset amount * liquidity, where 0 is fully illiquid, 1 is fully liquid) | Sum |

| total_liquidity_received | Total liquidity of assets received (asset amount * liquidity, where 0 is fully illiquid, 1 is fully liquid) | Sum |

| total_usd_cost_held | Total USD cost of assets held (asset amount * cost) | Average |

| total_usd_cost_sent | Total USD cost of assets received (asset amount * cost) | Sum |

| total_usd_cost_received | Total USD cost of assets sent (asset amount * cost) | Sum |

| total_usd_value_held | Total USD value of assets held (asset amount * price) | Average |

| total_usd_value_sent | Total USD value of assets received (asset amount * price) | Sum |

| total_usd_value_received | Total USD value of assets sent (asset amount * price) | Sum |

Notes

This metric is only delivered via flat file.

Data is grouped in the groups of the Age, Gain, Liquidity, and Wealth metrics. In addition, data is grouped by entity category. So, for example, it describes the amount of assets held by self-hosted entities that are 2 to 4 weeks old, have experienced a 10 to 25% USD gain, are illiquid, and have a balance of 10 to 100 units of the asset.

The weighted average age of holdings across groups can be calculated (within a time period) by summing, across groups, total_age_held and, separately, assets_held, then dividing the sum of total_age_held by the sum of assets_held. This can be applied equivalently to sent and received variables. It can also be applied equivalently for the average cost, using total_usd_cost_held, gain, using total_usd_value_held minus total_usd_cost_held, and liquidity, using total_liquidity_held.

The weighted average holdings across groups can be calculated (within a time period) by summing, across groups, assets_held and, separately, entities_held, then dividing the sum of assets_held by the sum of entities_held. This can be applied equivalently to sent and received variables.

The properties of assets sent are the properties of assets held by the entities that send assets in a time period, while the properties of assets received are the properties of the assets held by the entities that receive assets in a time period. So comparing the groups that send versus receive indicates how the properties of the supply are changing.

Fast spent entities, entities that hold assets for less than 24 hours, are excluded from this metric.

Data is weekly, so it contains data generated between 00:00:00Z on a Monday and ends at 23:59:59Z on a Sunday. Variables that describe a flow, such as assets sent or received, give data on the flow occurring between the start and the end of the week. For example, data for the week of 2020-01-06 describes the assets sent or received between 2020-01-06T00:00:00Z and 2020-01-12T23:59:59Z. Variables that describe a state, such as assets held, give data on the state at the end of the week. For example, data for the week of 2020-01-06 describes the assets held as of 2020-01-12T23:59:59Z.

Category balance

curl "https://api.markets.chainalysis.com/v1/supply/category-balance?asset=BTC"

-H "token: 948cf07be9c989d637"

The above command returns JSON structured like this:

[

{

"time": "2022-05-02",

"category": "crypto-to-fiat exchanges",

"asset_amount_held": 1217306.2872,

"usd_amount_held": 46882129210.1428,

"btc_amount_held": 1217306.2872,

"asset_amount_sourced": 5781578.9896,

"usd_amount_sourced": 222666009440.8432,

"btc_amount_sourced": 5781578.9896,

"asset_amount_destined": 316510.1877,

"usd_amount_destined": 12189760023.499,

"btc_amount_destined": 316510.1877

},

{

"time": "2022-04-18",

"category": "crypto-to-fiat exchanges",

"asset_amount_held": 1256748.3652,

"usd_amount_held": 51290313739.8345,

"btc_amount_held": 1256748.3652,

"asset_amount_sourced": 5757736.5604,